Anti Fraud Consultants – EN neu

Your partner in fraud prevention

Fraud is dynamic and company-specific. Our mission as anti-fraud consultants is to know current fraud trends and their solutions and to implement them for our clients.

We help you to clarify and present the business case for anti-fraud measures, to build or improve solutions and to optimize your processes and training measures.

Contact us if you have any questions about fraud!

This is how we support you with our fraud training offers

We maintain ongoing communication with companies and industry experts, actively exchanging information regarding the latest fraud trends during conferences and events. By sharing our knowledge and experience, we aim to empower you to effectively recognize and combat fraud. Our contribution extends beyond just sharing our knowledge; we also provide you with the motivation to serve as the vanguard against fraudsters.

For beginners

This training is suitable for those who are new to fraud prevention or have little opportunity to interact with fraud fighters from other companies.

Content & Goals

- Make decisions quickly and confidently

- Recognize known fraud patterns

- Finding new patterns

- International fraud trends

- Reduce friction for good customers, while fighting fraud

Tools, rules, procedures

For advanced and managers

This training is suitable for anyone who wants to expand and develop their knowledge and passion for fraud prevention.

Content & Goals

- Maintaining motivation

- Finding the right personnel for the fight against fraud

- Qualities for successful fraud prevention

- Questions for interviews

- Advanced rule creation and pattern recognition: go beyond the standard to detect more fraud

- Sharing, networking, collaborating: Building a network and finding the right groups and forums

For managers, compliance & money laundering officers

This training addresses issues and strategies for fraud prevention in finance, payments, money transfer and banking.

Content & Goals

- Fraud strategy and organization

- Detecting fraud and dissecting the perpetrators

- Reducing false positives and negatives

- Calculating the business case for prevention

- Benefits and limitations of artificial intelligence

- B2B fraud: differences, procedures, problems

- What do we really need? Systems and data sources

- Reporting: KPIs for lasting success

In-Depth Tour Through the Dark Web

This training is suitable for anyone who wants to learn more about the marketplaces, illegal services and trading on the Dark Web.

Content & Goals

- History of the Dark Web

- Why does the dark web exist?

- Positive and negative benefits of the Dark Web

- Why is the Dark Web or illegal marketplaces not simply shut down?

- Access to the Dark Web

- TOR and TAILs

- How can I surf the Dark Web safely?

- Trade in the Dark Web: parallels and differences to legal online trade

- Known marketplaces on the Dark Web

- Cryptocurrency as a means of payment

- Illegal trade off the dark web

- How can I use the Dark Web for my own fraud prevention?

Basic or Customized Training Sessions

In the basic version, we offer non-individualized standard training.

Our individualized training is even better. We take your cases and examples, and extract screenshots from your systems in order to review and help optimize your processes.

The duration of our training sessions ranges from two to four hours, plus breaks. We offer both remote and on-site training options.

The standard training sessions, without customization, are priced at 750,- Euro (net).

We offer a range of services including fraud checks, workshops, and sparring partners:

In our fraud checks, we meticulously examine and benchmark both your external and internal processes and systems. Our analysis encompasses existing measures and procedures, and we develop an optimization plan that factors in effort and potential gains. This service can also be seamlessly integrated with analytics and comprehensive system testing.

Transparency is a cornerstone of effective fraud prevention. While it’s impossible to completely eliminate all risks, we believe in acknowledging and addressing these risks with suitable measures. Sometimes, gaining an external perspective is key to achieving this goal.

Upon request, we are available to facilitate and moderate workshops with diverse objectives centered around fraud prevention. These workshops could range from fostering clarity within your organization, scrutinizing specific processes, to reevaluating past instances of fraud.

Expertise in prevention often tends to be concentrated within a few individuals. We position ourselves as your sparring partner, providing you with the much-needed professional and transparent dialogue that involves practical action rather than mere discussion.

Following an initial consultation, we tailor these services to your specific needs, offering them either through a flexible call-off arrangement or at a fixed price.

Analytics in consulting

We start with an assessment of the present state. In our technical consultations, we meticulously examine your processes and existing systems. Collaborating closely with our team of analysts, we extend the following services:

– False positive review: Exposing hidden instances of fraud that have gone unnoticed

– Crafting business cases for overhauling internal processes and procedures, and their implementation

– Conducting value-added analyses to leverage supplementary data sources

Our Fraud Health Check seamlessly integrates professional consultancy and cutting-edge analytics into a single comprehensive package. We establish benchmarks for your systems and methodologies while charting a course for further advancement. All of this is offered at an attractive fixed price.

Fraud Circles – because fraud prevention is not a competition!

Our Fraud Circles provide the perfect opportunity for cross-company knowledge exchange and sharing. Here, we discuss current fraud trends, patterns and how to potentially combat them. We currently offer them for the following industries:

– Finance (focus on consumer lending business),

– Payment (eCommerce, PSPs and Issuer)

– Digital Goods & Game Providers (international, in English)

If we get many questions or notifications about a specific fraud trend, we also conduct Fraud Circles on current trends. Examples are refund fraud, B2B fraud or triangulation fraud.

To ensure a safe and relevant exchange, participation is only available via invite, and selling, pitching or solution providers are excluded from joining. If you are interested in participating in one of our fraud circles, please contact us via our contact form.

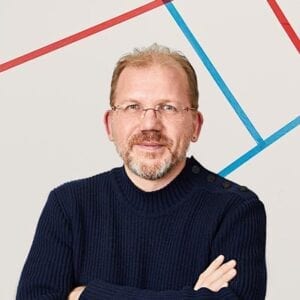

Bundled expertise

We are your sparring partner in fraud prevention and look forward to exchanging ideas with you!

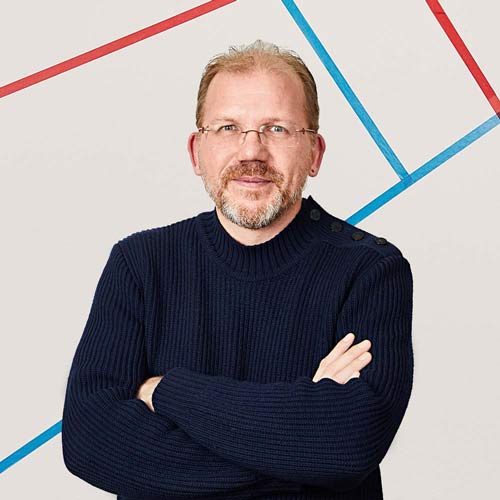

Dirk Mayer

Head of Anti-Fraud Consultants

Bandled expertise

We share our years of expert knowledge and training and workshops to help you build in-house expertise.

Fraud Checks & Workshops

We evaluate data and processes and optimize them based on the latest best practices in fraud prevention.

Fraud Circles

We offer a platform for intra- and inter-industry exchange in fraud prevention.