Using Innovation Against Fraud

Fraudsters put a lot of energy into finding gaps in companies’ fraud prevention methods. They use all available tools to conceal their identity, such as VPNs and software to simulate devices. In order to detect all of these tricks, we continuously work on our software and analyze data and fraud patterns. This enables us to close security gaps and minimize the damage caused by new types of fraud patterns. Our goal: to always be technically one step ahead of the fraudsters.

We Are Always Looking for new Fraud Prevention Solutions

The Dream Team: Man and Machine

Machine learning is often seen as a panacea in fraud prevention. However, our motto is: Algorithms and human expertise complement each other perfectly. Our data science team continuously feeds RISK IDENT’s machine learning algorithms with new data that identifies the majority of fraud. But fraudsters continue to cleverly trick fraud prevention systems. Fraud managers can use their human creativity and experience to quickly identify and close these new gaps, because they are able to see more than just patterns in data — fraud managers are able to interpret the “story” behind a transaction.

Customizable for Your Needs

Almost every company has to deal with different types of fraud. A one-size-fits-all solution is often not practical. RISK IDENT’s DEVICE IDENT and FRIDA solutions are customized and highly configurable. Algorithms and fraud-scoring rules are flexibly adapted to provide a solution tailored to the specific business model and available data. This is the only way to achieve the highest possible precision in detecting fraud patterns and avoiding false positives.

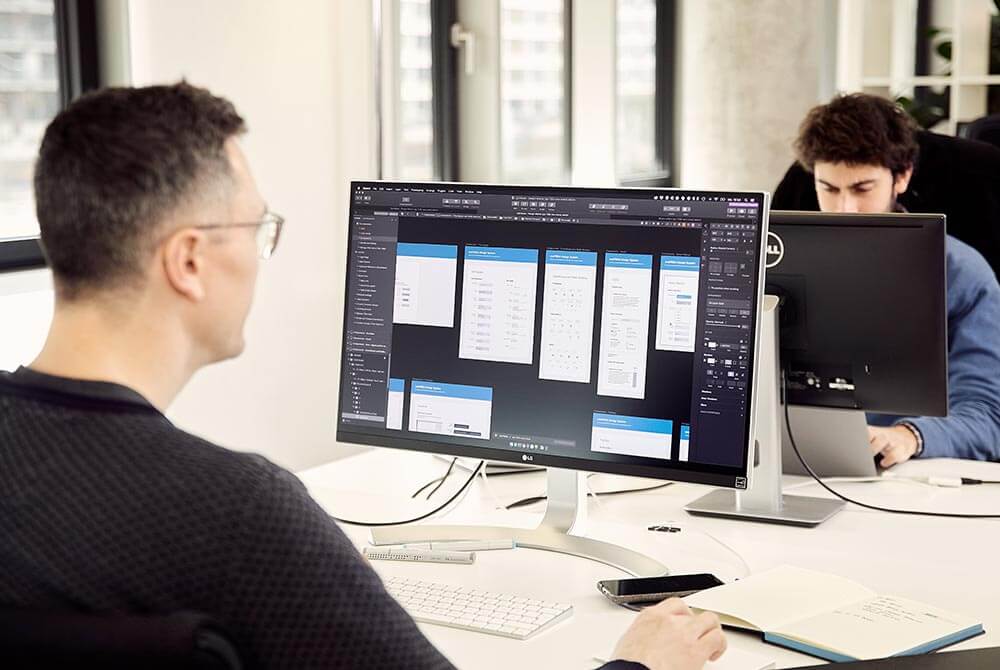

Intuitive Front-End: A Control Center to Combat Fraud

Our software combines all relevant transaction data such as names, address information, device information and means of payment. In addition, our systems are easily extendable: All other company-specific data sources can be integrated and evaluated. We combine all of this information in our user-friendly interface and provide users with efficient analysis, filtering and evaluation options. This creates a holistic picture of each transaction, which makes it possible to recognize patterns. In this way, we also identify cases of fraud that would otherwise remain undetected.

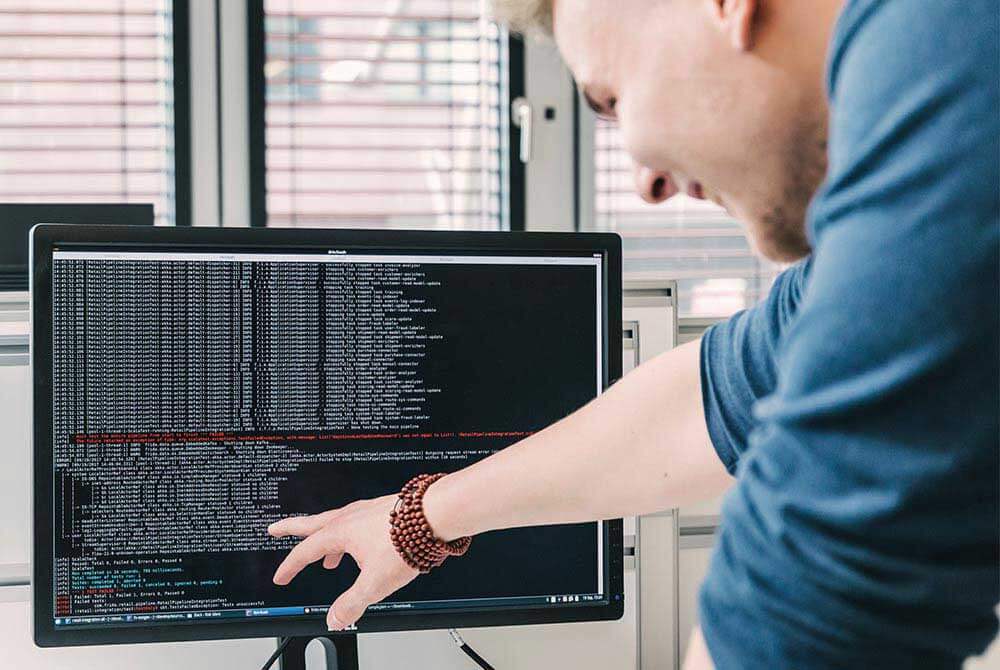

Software Development at RISK IDENT

We love technology! We use the latest software components available and continuously search for the most suitable solution for every task. The complete development of our tools takes place in-house at our Hamburg office. This means we have short paths and can quickly identify and stop new emerging types of fraud.

We Protect These Industries Every Day

Any Questions?

Frank Heisel

Managing Director

Artificial Intelligence and Expert Knowledge

Our software gives fraud managers all the tools they need to effectively combat fraud

Numerous Data Sources for Optimal Results

We combine all available data sources to have a holistic picture of fraud

Stop Fraud with the Click of a Mouse

Intuitive user interfaces and filters enable efficient and transparent scoring